An analysis of two years of functioning of AIIB

1.1. Introduction

China’s olden ‘Silk-Route’ is being recreated (proposed by Xi Jing Ping in 2013) under ‘Belt and Road Initiative’ and envisages creating massive infrastructure (roads, railway lines, ports and energy and rural infrastructure) in countries across four continents – Asia, Africa, Middle East, and Europe. Access to finances in these countries emerged as a major bottleneck. In order to fill up this gap, China-led international financial institution, the Asian Infrastructure Investment Bank (AIIB) was created. Some Chinese government officials and analysis said that growing dissatisfaction among emerging economies at the failure to reform the Bretton Woods Sisters’ (collective name for World Bank Group and International Monetary Fund – these financial institutions were established at Bretton Woods, New Hampshire, United States, and hence the sobriquet) decision-making system, encouraged China to set up the new international lender.

AIIB was officially established in December 2015 and opened for business in January 2016. India is among 57 founding members of AIIB, among these 37 are regional and 20 are non-regional. With headquarter in Beijing, AIIB has a 12-member Board of Directors. It has an authorised capital of US $100 billion and subscribed capital of US $ 50 billion. So far AIIB has 84 members including India. AIIB has an authorised capital of US $100 billion. China, India and Russia are the three largest shareholders of AIIB, taking 30.34%, 8.52%, 6.66% stake respectively. Their voting shares are 26.06%, 26.06%, 7.5% and 5.92% respectively. Germany ranks 4th stakeholder with 4.5%, followed by South Korea. China’s voting shares in AIIB gives Beijing effective veto power, as major bank decisions require at least 75% support.

Asian countries account for 75 percent of AIIB’s shares and non-Asian countries altogether account for 25 percent, which translate to voting power, but three out of the bank’s five vice presidents are European.

Two features make AIIB a distinct entity –

- Regional character of the Bank: Its regional members (Asian) will be the holding around 75 percent of shares i.e. they will be majority shareholders. They have been allocated their capital share on quota basis i.e. based on their economic size

- Voting share: For each member country it is based on the size of their economy and not on authorised capital share to the Bank.

1.2. Aims and Objectives

Its purpose is to provide finance to infrastructure development and regional connectivity projects in the Asia-Pacific region. Its goals are to boost economic development in Asia-Pacific region, provide infrastructure, and promote regional cooperation and partnership. It prioritises investment in energy, power generation, transport, rural infrastructure, environmental protection and logistics in Asia.

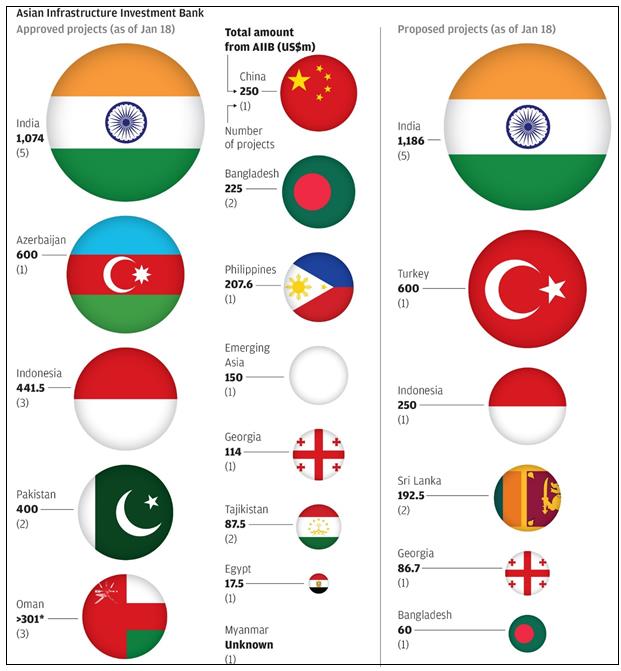

Figure 1 – Projects approved by and Awaiting Approval of AIIB (18 January 2018)

1.3. Round up of Two Years’ Functioning

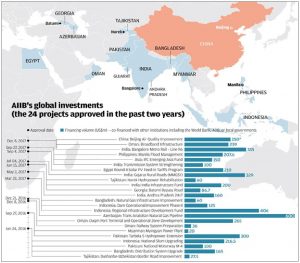

On 16 January 2018, AIIB completed its two years of functioning and it will be relevant to look at its operations. During this period (16 January 2016-16 January 2018), AIIB has approved funding for 24 infrastructure projects in 12 countries, worth around US $ 4.2 billion. As on 18 January 2018, 11 projects from 6 countries are awaiting approval from the Board of AIIB (see figure 1).

The geographical coverage of AIIB with 24 projects in operation is shown in Figure 2.

Figure 2 – Geographical coverage of AIIB with 24 projects in operation

1.4. AIIB and India

In January 2016, India’s Dinesh Sharma was elected to the first Board of Directors of the AIIB, through a secret ballot.

Out of 24 projects approved so far, five have been given to India – totalling USA $ 1.074 billion – accounting for almost 28% of the money it has lent. That is in stark contrast with earlier fears — largely from the West — that China would channel money through AIIB to its “friends” over its “rivals”, experts noted.

“India and China may have disputes – a common scenario for big neighbouring countries – but business is business,” said Zhao Gancheng, director of South Asia studies at the Shanghai Institute for International Studies.

In the backdrop of India boycotting Beijing’s ‘Belt and Road Initiative’ forum and warning countries involved in this (BRI) trade-development scheme they risked being saddled with ‘unsustainable debt burdens’, Indian relationship with AIIB looks somewhat puzzling if not outright paradoxical. In this regard, Indian scholars have portrayed China’s port-building activities in Pakistan, Sri Lanka and elsewhere in India’s backyard as ‘a string of pearls’ designed to contain their country, while Chinese investment in and loans to Nepal and Sri Lanka have also sparked unease.

Further, India is also trying to rein in a bilateral trade deficit that amounted to US$51 billion last financial year – on two-way trade totalling US$71.5 billion.

Amitendu Palit, a senior research fellow at the Institute of South Asian Studies at the National University of Singapore, said India had always been an enthusiastic supporter of the AIIB, which had adopted a multi-country, rules-based style of governance. “The AIIB has acquired the status of a multilateral lending initiative, so there is no problem for either India, or China, in overlooking bilateral differences and working together at the AIIB,” he said, adding that India wanted to open up investment opportunities in the region.

India viewpoint is that unlike the AIIB, which is being guided by transparent procedures and clear rules of law, the funding patterns of the projects under belt and road initiative are ambiguous. BRI is more of an initiative where countries are bilaterally negotiating with China to obtain funding for projects. This explains why India has boycotted BRI and supported AIIB.

Zhao Gancheng said China’s support of lending to India through the AIIB was a ‘completely business-based decision, like any other banks.’ He further said – “Investing in India is beneficial for China because the country is one of the most economically and politically stable countries in the region.”

India also has the most applications for AIIB funding awaiting approval, involving five projects seeking to borrow a total of US$1.19 billion. One of them, a metro line in the west coast city of Mumbai, is asking for US$500 million, which would be the AIIB’s biggest loan if approved.

Madhav Das Nalapat, director of the department of geopolitics and international relations at Manipal University, said he expected other Chinese banks would become big lenders to Indian companies, given the country’s vast funding needs and its “impeccable record” when it came to repaying loans.

Though Nalpat express optimism by saying – “Once trade between India and China crosses US$300 billion annually, which it will in about five years, the two countries will be close friends.” But Palit said the likelihood of further Sino-Indian collaboration on matters of common interest did not mean bilateral differences would subside. He said – “Differences would remain and both countries would have to work on those separately.”

1.5. Critique of AIIB

The primary aim of AIIB – to provide funds for BRI – has become a focal point of criticism of AIIB. Allaying fears In this regard, Joachim von Amsberg, AIIB vice-president of policy and strategy said on 23 January 2018 – “AIIB will strictly scrutinise projects put to the lender even if they are part of China’s ambitious Belt and Road Initiative.” He further said the bank would weigh market demands, environmental impacts and local regulations when picking projects to back.

Critics have said China has too big a say in the bank and many of the belt and road projects are in nations with high security risks, making returns tougher to come by. Joachim von Amsberg disagrees by saying that the bank remained a multilateral institution even though China was the AIIB’s biggest shareholder. He said the AIIB and the belt and road initiative overlapped but the two were very different, with the AIIB also financing many other projects not related to the strategy.

He reiterated that – “Belt and road is a slogan and an initiative that has very fuzzy boundaries, very fuzzy borders. We see these two different entities: one is a bank, another is a Chinese initiative called belt and road. We look at the projects [on the belt and road] with the same due diligence as we review other projects.”

Jin Liqun, former finance minister of china and first President of AIIB while speaking at an event jointly hosted by think tanks the Bruegel and the Egmont Institute on 23 January 2018, explicitly stated – “China does not control or dominate the decision-making of the AIIB,”. He further corroborated it by stating that that only 24 months into operation and the bank received top ratings from all three international credit rating agencies.

At the end of his speech, Jin concluded by saying – “I had got very clear message from the Chinese authority: this (AIIB) is going to be an international bank; (it) is not a Chinese bank and I would do it independently.”

A major area of concern which will emerge, sooner or later, is environmental and social impacts of AIIB funded projects. World Bank and Asian Development Bank have clearly-spelled out mechanisms for mitigation of adverse impacts. AIIB has very sketchy rudimentary text in this regard. Secondly, some of the AIIB funded projects are co-funded with WB, ADB or some other international financial institutes. Will the environmental and social framework of World Bank and Asian Development Bank will be followed in such projects?

1.6. The Chequered history of aiib

Throughout late 2013 and 2014, China canvassed support for the AIIB around the region. Australia was invited to become a founding member and was offered ‘a senior role in running the bank’. As little was then publicly known about the AIIB, this offer was not widely discussed in Australia. On 24 October 2014, the AIIB was formally launched in Beijing when twenty-two countries (including China) signed a Memorandum of Understanding (MOU) that officially recognised the bank’s establishment and declared its headquarters would be in Beijing.

US President Barack Obama and Secretary of State John Kerry both opposed the AIIB because of concerns that China would dominate the new institution and make lending decisions that were based on China’s national interest, that lending standards would disregard environmental and human rights protections and that the AIIB would compete with existing MDBs such as the US-led World Bank and Japanese-led ADB. Abbott also consulted with Japanese Prime Minister Shinzō Abe, who likewise urged him to preserve the existing MDB regime. In response, China said that the AIIB is designed to ‘cooperate’ with existing development banks and its governance will be ‘lean, clean and green’. Many observers interpreted the US and Japan’s opposition as based on hostility towards China’s rising regional influence.

On 11 March 2015 the Cameron Conservative government in the UK made the surprise announcement that it would become the ‘first major Western country’ (and American ally) to join the AIIB, drawing a strong rebuke from the US. The UK decision opened the floodgates for other Western countries to join, and Germany, France and Italy soon followed suit. The impending sign-up deadline and strong indications of a policy shift from the Australian government generated another flurry of pro-AIIB commentary locally.

Finally, overcoming its initial reluctance in joining AIIB, on 29 March 2015, the Abbott government announced that Australia would sign the AIIB MOU and ‘participate as a prospective founding member in the negotiation of setting up the bank’. It stated that while Australia’s full membership of the AIIB would still depend on China implementing high-level lending oversight, China had improved its proposed governance structure sufficiently and Australia declared it was committed to addressing regional infrastructure shortages. Hockey and Robb said Australia would also encourage Japan and the US to join the bank. Shortly after Australia’s decision, fellow regional US ally South Korea also announced that it would apply to join the AIIB as a PFM.

Australia eventually signed up as a ‘founding member’ in June 2015, contributing A $ 930 million of ‘paid-in’ capital to the bank over five years, making it the sixth largest stake holder.

1.7. Impacts of Infrastructure/development projects

Development literature is replete with cases after cases on the adverse impacts of infrastructure/development projects in India raising a very pertinent question – who reaps the benefits and who pays the price. The marginalized, tribals, minorities and other vulnerable communities almost always bear the brunt of such projects coupled with irrevocable destruction of environment and ecology of the area affected. According to a modest estimate, more than 50 million people have been uprooted from their native lands and livelihood by the development projects in last seven decades (Walter Fernandes). The pathetic state of rehabilitation can be understood from the fact that communities uprooted by the first major water development project – Hirakud dam in 1954 – are still struggling for their resettlement and rehabilitation.

Similarly, environment has been destroyed beyond recovery owing to ill-flawed and poorly conceived development projects, since inception in 1947. In the early two decades of post-independence period, official policy allowed the felling of dense forests unscientifically to pave way for agriculture, in total contradiction of land use capability classification. Hence after few years, such converted thousands of hectare lands became unfit for agriculture and permanently became fallow lands. It takes centuries to raise a dense forest of 4% canopy and that is why till date nowhere man-made plantations have been transformed into forests.

Land is one resource which cannot be generated in labs and is a fixed resource (except for some European nations, especially Netherlands, which has reclaimed some land from sea). India has barely 2.7% of global landmass on which almost 18% of global population lives. The rate at which land is getting converted from agricultural to non-agricultural use, sooner than later a crisis is just waiting to happen on the front of agricultural produce. It has the potential to ignite a civil war in the country. Easier availability of funds from AIIB will only accelerate this crisis manifold. It is high time, if not already late, to make a year-wise estimation of loss of agriculture land for other purposes, especially in post-liberalization (circa 1990 onwards).

Keeping the massive human tragedies and environmental losses emanating as a consequence of developmental projects in India in last seven decades, one can safely conclude that AIIB will aggravate this situation further.

1.8. AIIB – Future Plans

China-led Asian Infrastructure Investment Bank (AIIB) is planning to issue its first US dollar-denominated bond with minimum worth of $1 billion by June 2018. The earliest issuance window of bond will be toward end of first half of 2018 with time required for certain procedures, including Board of Governors’ approval of AIIB’s 2017 financial statements as well as borrowing and swap documentation.

The minimum size of the issuance will be one billion dollars, but as demand for the first bond issue may increase AIIB anticipates of having to issue a larger size.

The maturity of the bond will be between three and five years depending on investor demand at the time. The bank plans to cap its total borrowing volume at US $3 billion dollars in 2018.

The AIIB has received three top-notch ratings from global credit rating agencies S&P Global Ratings, Moody’s and Fitch in recognition of the bank’s strong capital base and stable outlook.

Towards the end, it can be said that AIIB is still in its infancy and the true picture will emerge after few years, especially when some country other than China becomes the largest stake-holder. Very soon (in five years) Australia will substitute China and then true scenario will unfold. But one thing is certainly clear – AIIB emerged as a response to erase the shortfalls of Bretton Wood institutes, yet it is following exactly the same contours which leaves concerned citizens worried about the future of global economy and its devastating impacts on people, environment and ecology.

Author- Arun Kumar Singh

Recent Comments